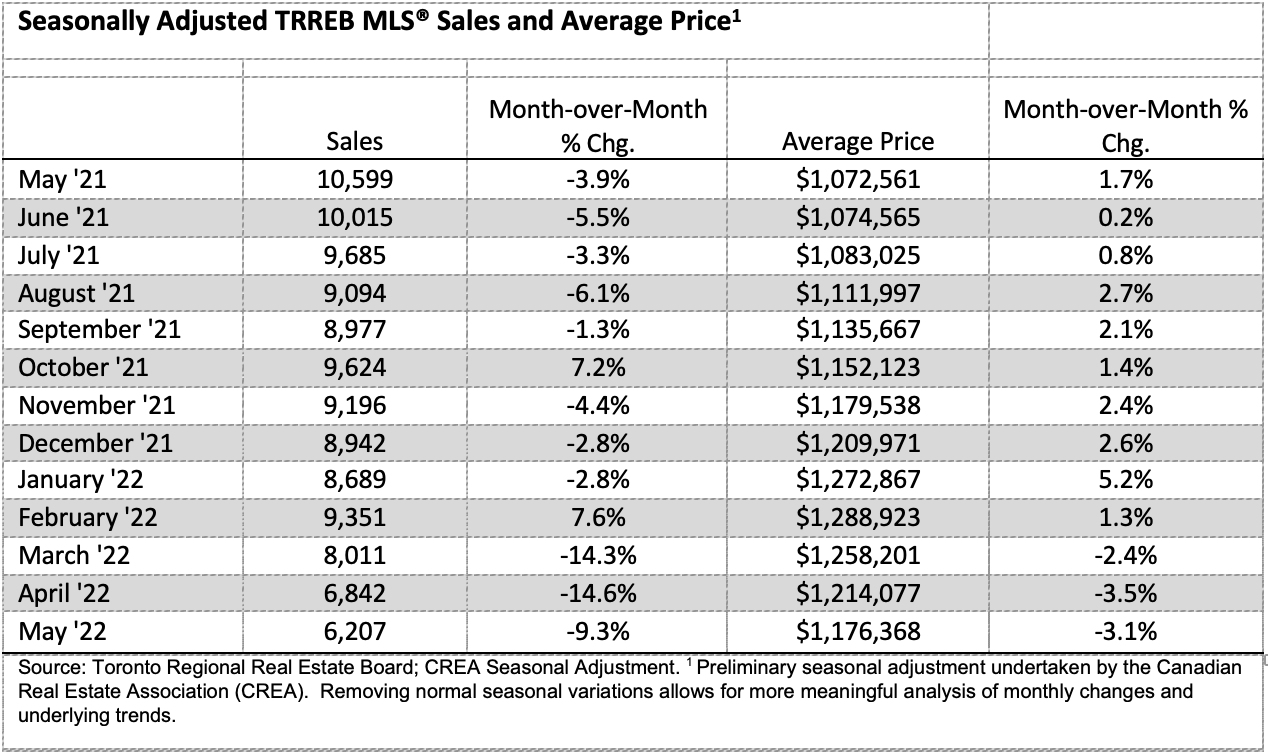

TORONTO, ONTARIO, June 3, 2022 – Greater Toronto Area (GTA) housing market conditions continued to evolve in response to higher borrowing costs. Similar to April results, May 2022 sales were down on a monthly and annual basis. Conversely, active listings at the end of May were up on a month-over-month and year-over-year basis. More balanced market conditions have provided buyers with more negotiating power. As a result, while benchmark and average home prices were up substantially compared to last year, selling prices trended lower on a month-over-month basis.

“Bank of Canada rate hikes, including the 50-basis point hike on June 1, are impacting home buyers in the short term. There is now a psychological aspect where potential buyers are waiting for a bottom in price. This will likely continue through the summer. However, as home buyers adjust to higher borrowing costs, housing demand will be supported by extremely low unemployment, high job vacancies, rising incomes and record immigration,” said TRREB President Kevin Crigger.

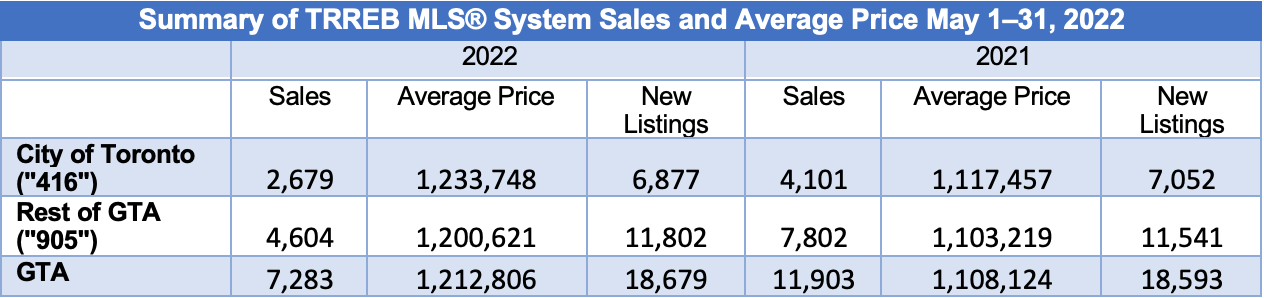

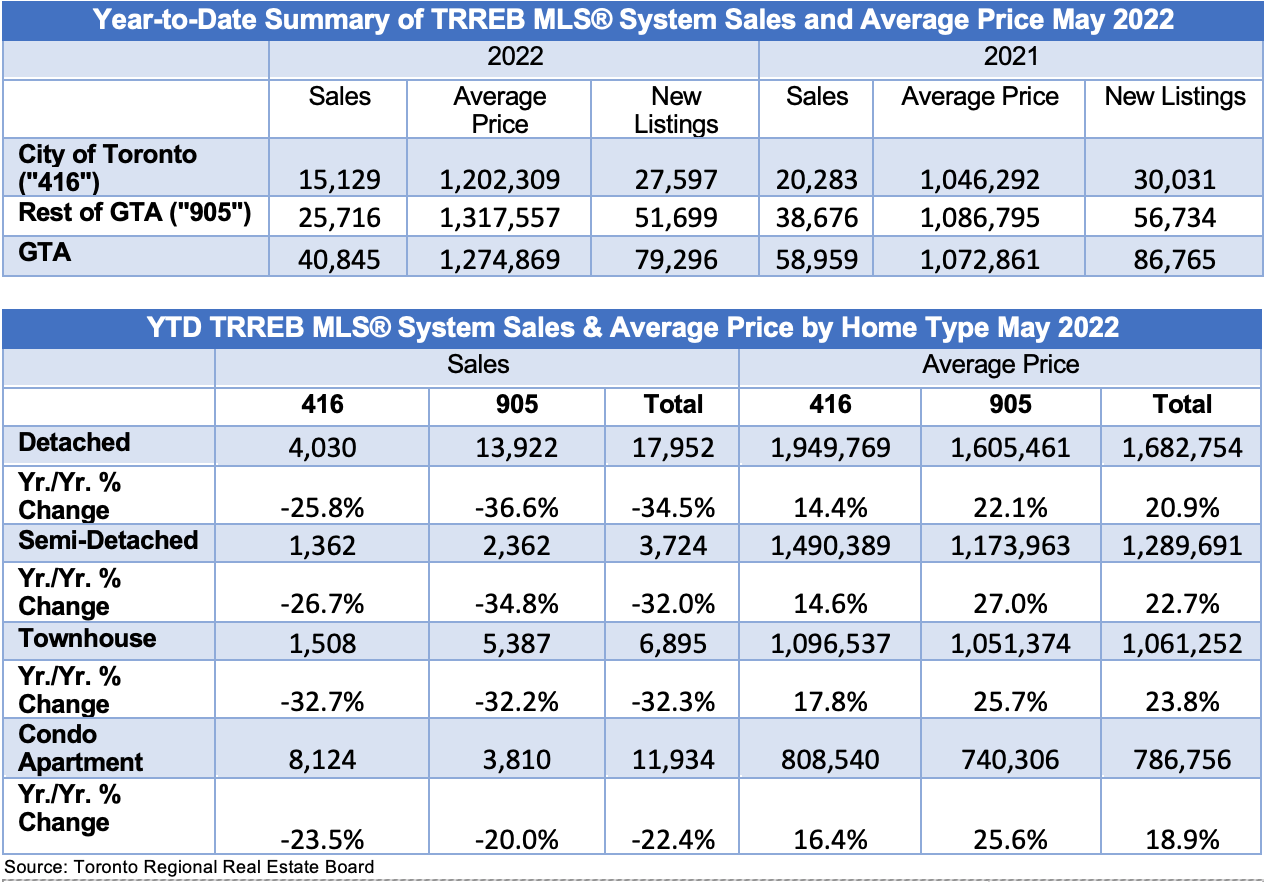

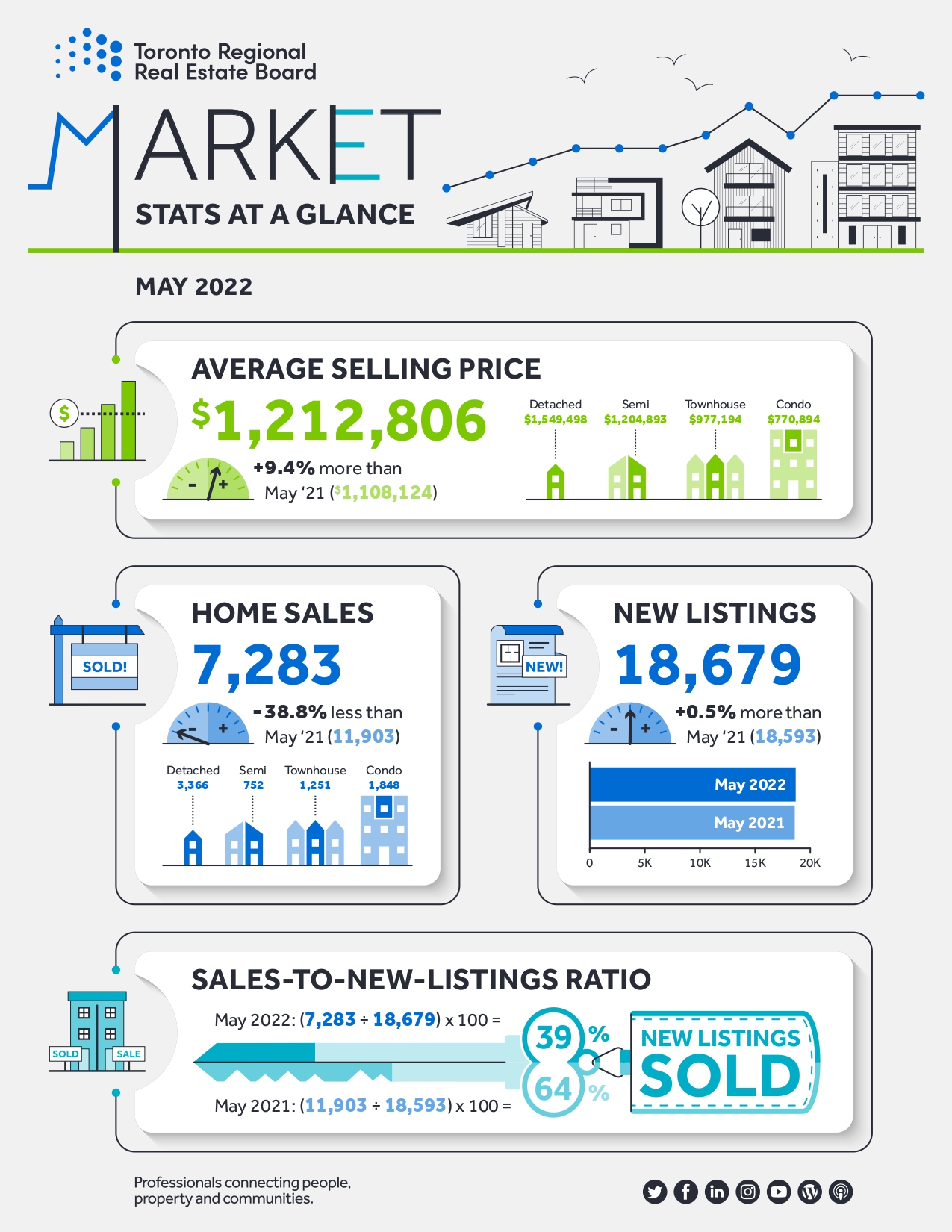

GTA REALTORS® reported 7,283 sales through TRREB’s MLS® System in May 2022 – down 38.8 per cent compared to May 2021 and down nine per cent compared to April 2022. The number of new May listings was similar to last year’s level and edged up on a month-over-month basis. With sales down and new listings trend flat to slightly up, the number of active listings was up on a year-over-year basis by 26 per cent.

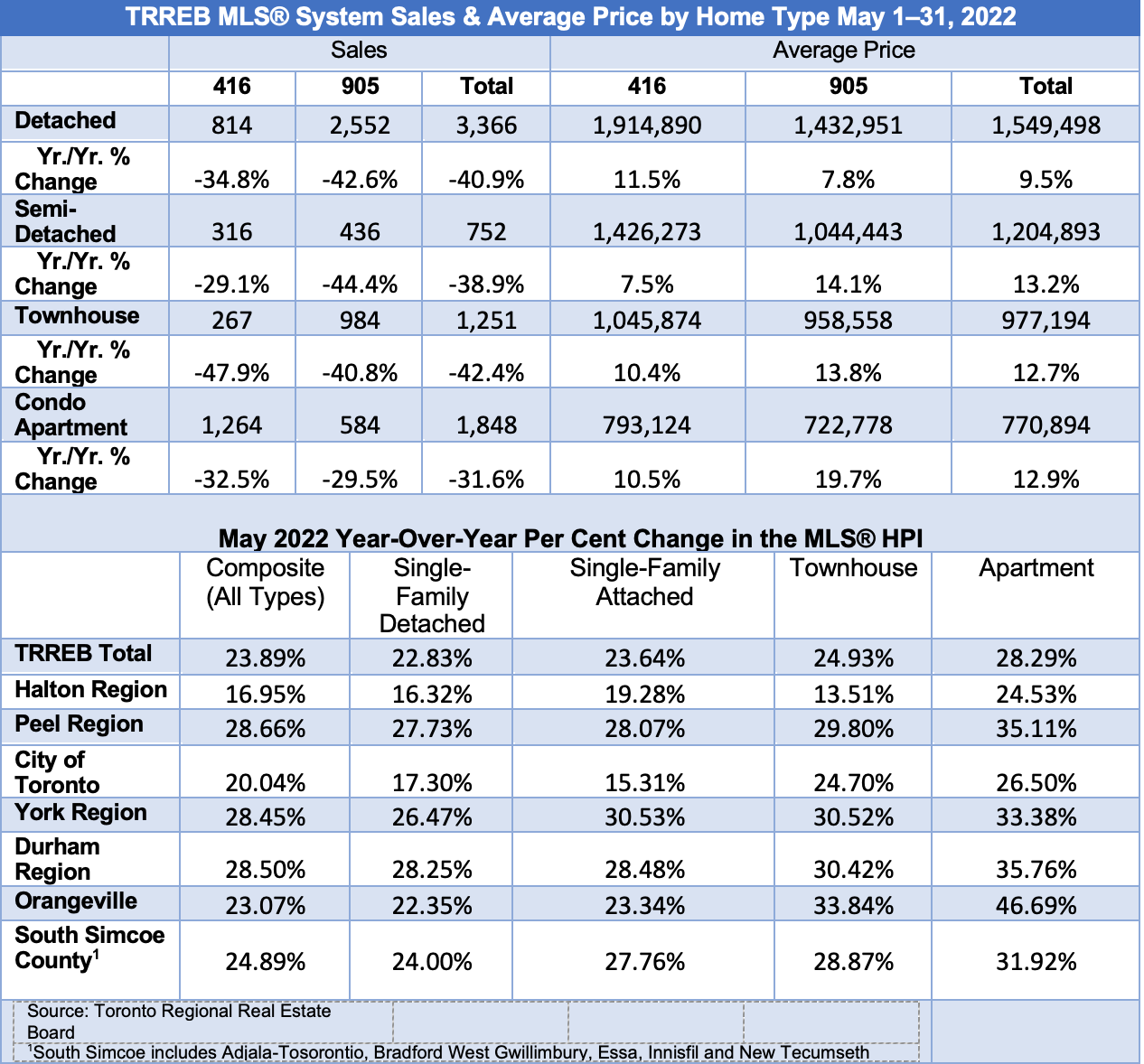

Market conditions remained tight enough to support an overall average selling price of $1,212,806 for May 2022, representing an annual growth rate of 9.4 per cent. The MLS® Home Price Index Composite Benchmark was also up on a year-over-year basis by 23.9 per cent. On a month-over-month basis, both price metrics were lower, reflecting more balanced market conditions.

“Price trends observed over the past three months – both in terms of moderating annual growth rates and the recent month-over-month dips – are in line with TRREB’s forecast for 2022. After a strong start to the year, the current rate tightening cycle has changed market dynamics, with many potential home buyers putting their purchase on hold. This has led to more balance in the market, providing buyers with more negotiating power,” said TRREB Chief Market Analyst Jason Mercer.

“The recent elections have shown that senior levels of government understand the need for more housing to support regional growth. The approval of new and more diverse housing types happens at the municipal level, subject to provincial laws and regulations. It will be important to understand the stance of local policymakers as we move toward the fall local elections. The shorter term impact of higher interest rates will not be with us forever. Supply remains the long-term challenge,” said TRREB CEO John DiMichele.

Please note the methodology used to calculate MLS® HPI has been changed, For more information, click HERE.

READ THE FULL REPORT.

Media Inquiries:

Genevieve Grant, Public Affairs Specialist genevieve.grant@trreb.ca 416-443-8159

The Toronto Regional Real Estate Board is Canada’s largest real estate board with more than 67,000 residential and commercial professionals connecting people, property and communities.