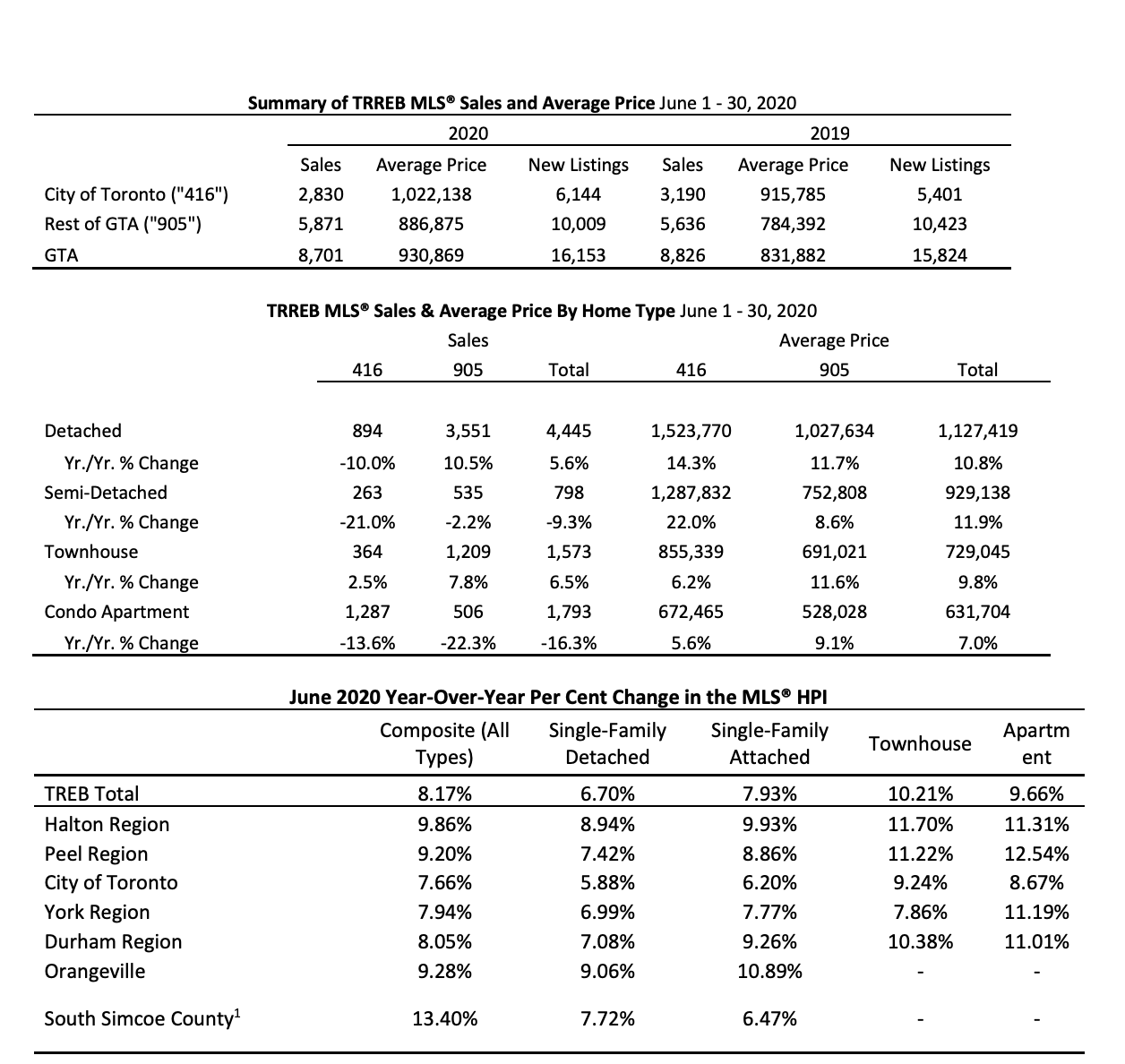

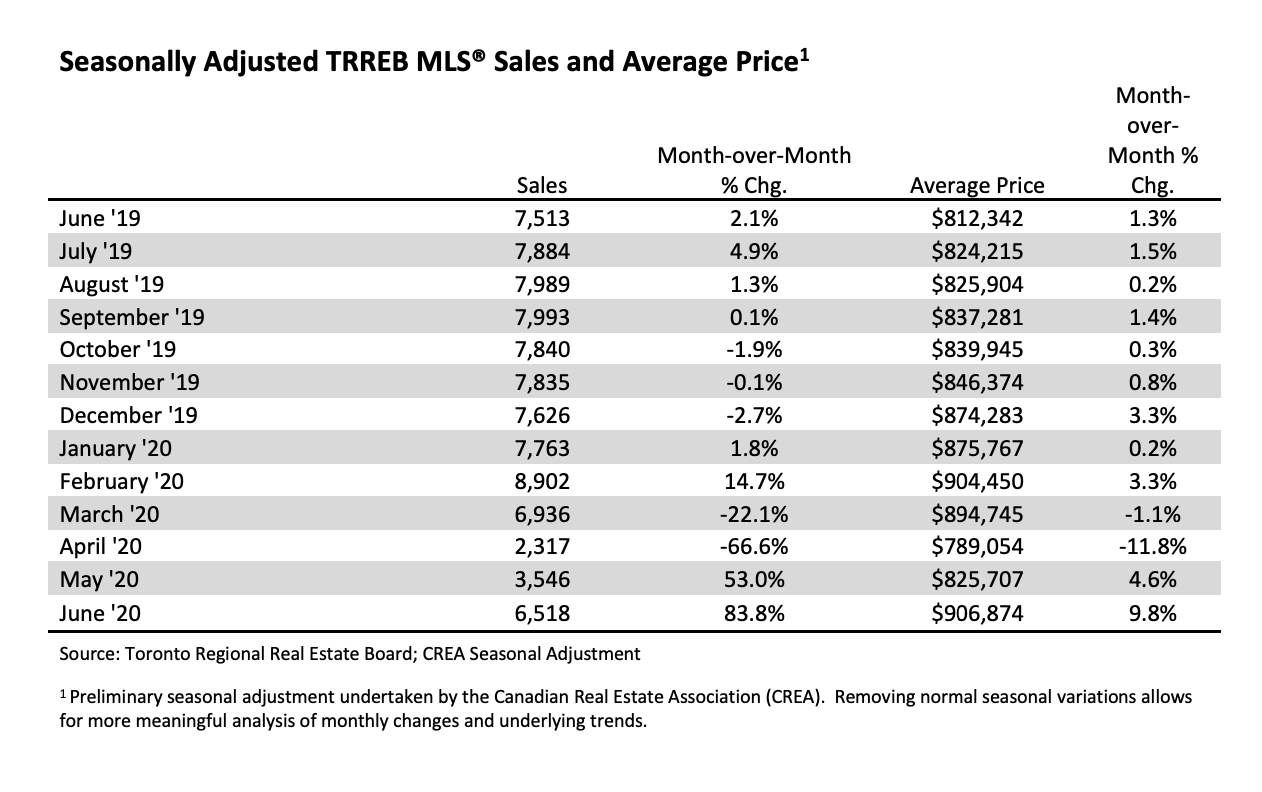

TORONTO, ONTARIO, July 7, 2020 – Toronto Regional Real Estate Board President Lisa Patel announced that Greater Toronto Area REALTORS® reported 8,701 sales through TRREB’s MLS® System in June 2020. This result represented a very substantial increase over the May 2020 sales result, both on an actual (+89 per cent) and seasonally adjusted basis (+84 per cent), and was only down by 1.4 per cent compared to June 2019.

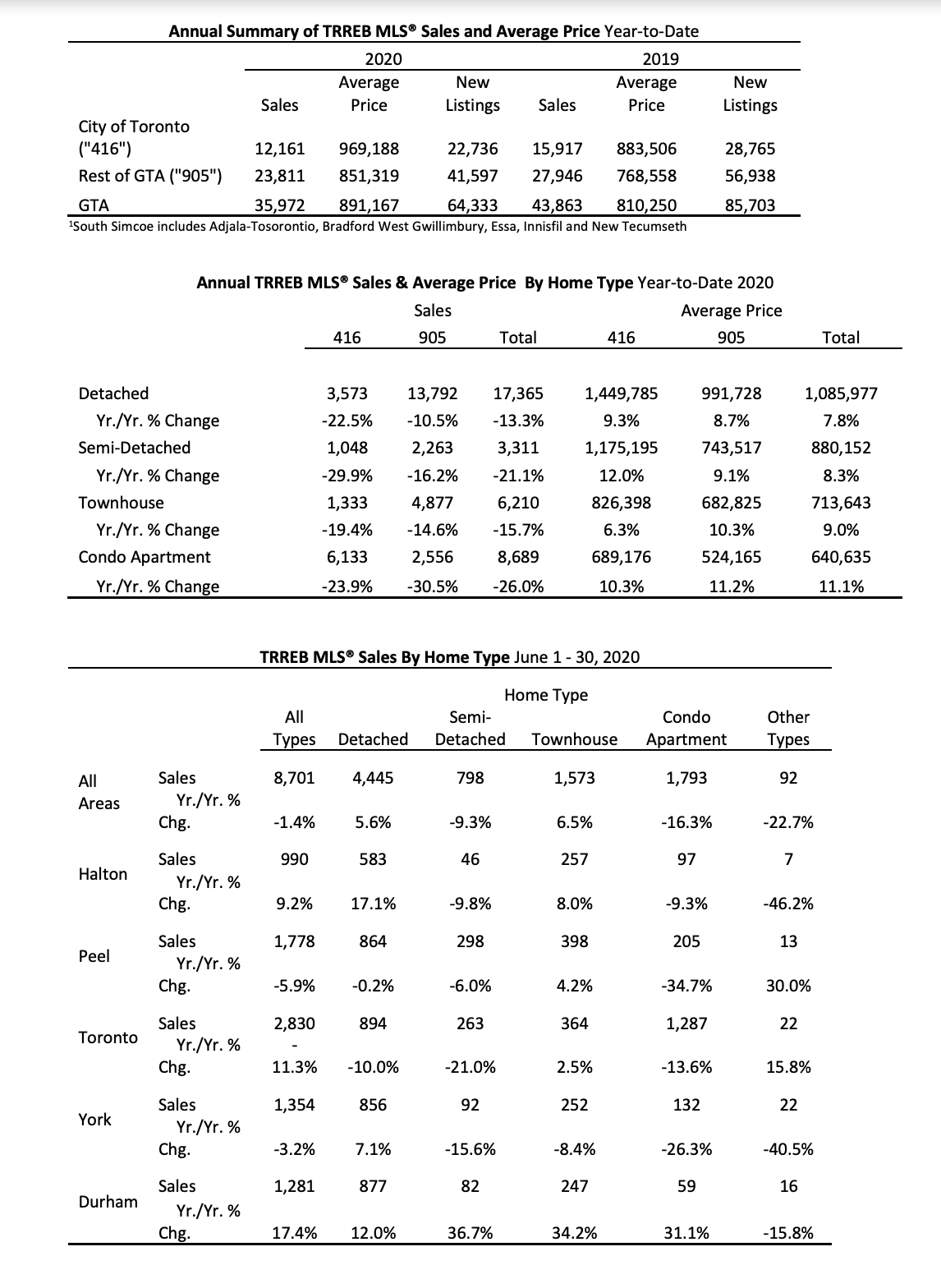

Year-over-year growth in sales was reported in some areas and market segments. Especially notable were the detached and townhouse market segments in the GTA regions surrounding the City of Toronto.

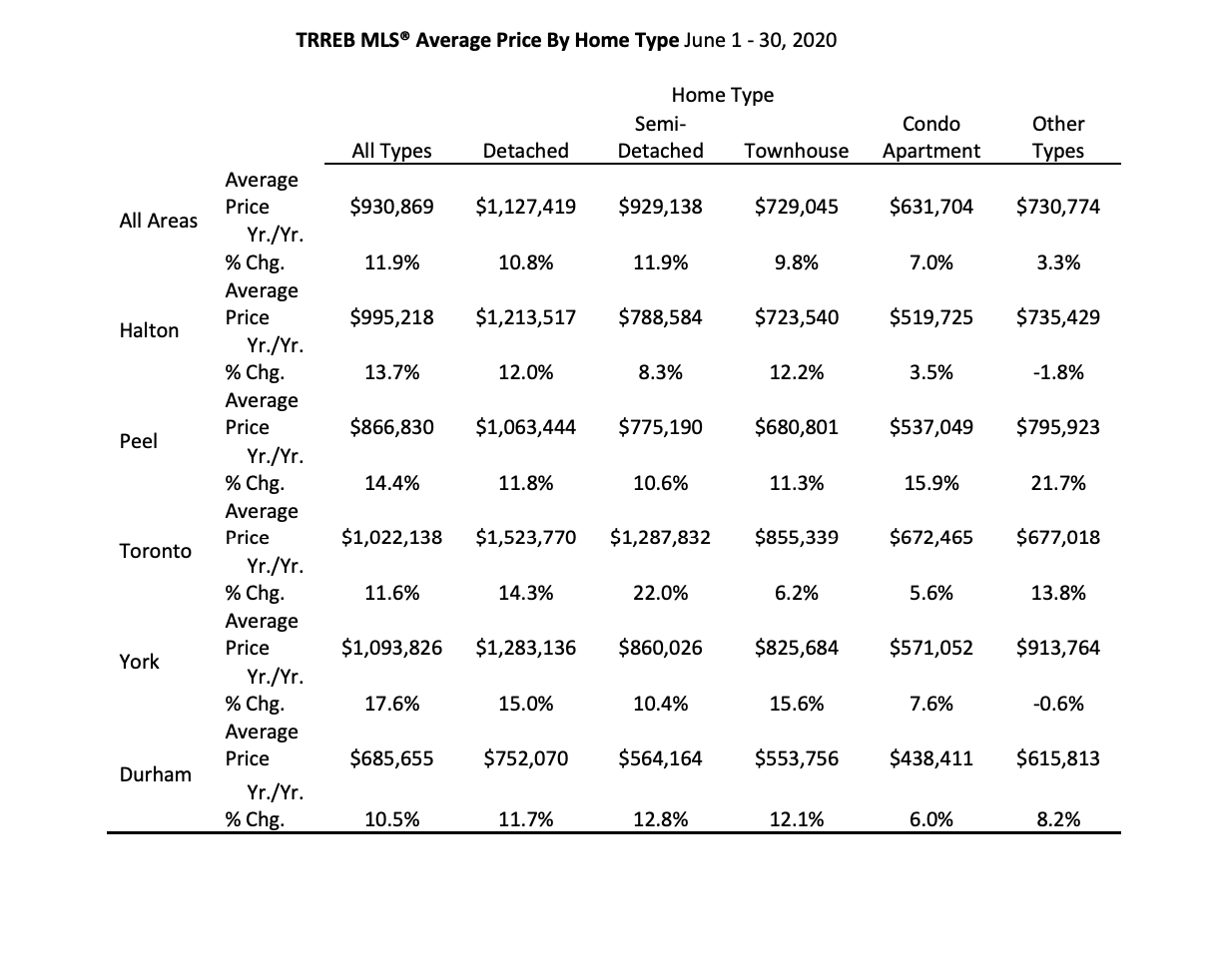

The MLS® Home Price Index Composite Benchmark was up by 8.2 per cent year-over-year in June. The average selling price for all home types combined was $930,869 – up by 11.9 per cent compared to June 2019. The actual and seasonally-adjusted average selling price was also up substantially compared to May 2020, by 7.8 per cent and 9.8 per cent respectively.

Average and benchmark selling prices were up year-over-year for all major home types. The strongest average annual rates of price growth were experienced in the detached and semi-detached market segments in the City of Toronto at 14.3 per cent and 22 per cent respectively. This, coupled with the fact that average selling price growth outstripped growth in the MLS® HPI benchmarks, points to a resurgence in the higher-end market segments.

“Following the broader movement to reopen the economy in June, we experienced a very positive result in terms of home sales and selling prices. Before the onset of COVID-19, there was a great deal of pent-up demand in the market. This pent-up demand arguably increased further over the past three months. We are still in the early days of recovery, but barring any setbacks, we should continue to see stronger market conditions in the second half of 2020 as households look to satisfy their ownership housing needs,” said Ms. Patel.

New listings were up slightly on a year-over-year basis by 2.1 per cent. However, active listings on TRREB’s MLS® System at the end of June 2020 were down by 28.8 per cent compared to June 2019. Growth in new listings will need to outstrip growth in sales for a number of months before active listings approach last year’s levels.

“It will be important to closely monitor housing market conditions as economic recovery continues in the second half of 2020 and into 2021. Policy makers should proceed cautiously with any demand-side stimulus. The persistent lack of listing inventory in the GTA understandably took a back seat to COVID- related issues in the short term, but supply should once again be top-of-mind once the recovery takes hold, in order to ensure long-term affordability in the GTA,” said TRREB CEO John DiMichele.

Updated Ipsos Polling Results on Consumer Buying and Selling Intentions

In order to further gauge the impact of COVID-19 on the GTA housing market and to gain insight on what the future holds for housing demand and supply, TRREB undertook a second wave of consumer polling through Ipsos between May 25 and May 31 2020. Key findings include:

- In line with the Ipsos polling results for April, 27 per cent of respondents said they were likely (very likely or somewhat likely) to purchase a home over the next 12 months. This result was below the spring 2019 result of 31 per cent, but given the credibility interval of +/- 3.9 percentage points, the result remained in line with past polling results.

- Listing intentions, while up from the April Ipsos poll (21 per cent in May versus 17 per cent in April), the result remained well-below the 32 per cent listings intentions mark recorded in the spring of 2019.

The gap between buying intentions and listing intentions follows the broader trend exhibited in the GTA over the past few years and underpins the requirement of policy makers to take action on the housing supply front, both in terms of aggregate supply and increasing the diversity of housing types available to home buyers.

Housing Market Outlook Update

In February 2020, TRREB released its housing market outlook in its Market Year in Review and Outlook Report. At that time, TRREB was forecasting 97,000 sales for 2020. Given the impact of COVID-19 on the level of home sales in March, April and May of this year, the 97,000 sales mark will not likely be attainable in 2020. However, given the strong hand-off from June 2020, if sales follow the regular seasonal pattern in the second half of this year, 80,000 sales will be a realistic target.

If sales reach the 80,000 mark, this would represent an 8.8 per cent decline compared to 2019. For reference, sales through the first six months of 2020 amounted to 35,972 – down 18.5 per cent compared to the same period in 2019.

TRREB’s average price forecast released in February 2020 was $900,000. Given the current relationship between sales and listings in the GTA coupled with the strong hand-off from June 2020, this forecast remains realistic. In fact, if market conditions continue to unfold as they did in June, it is possible that the average price for 2020 could edge above the $900,000 mark. Through the first six months of 2020, the average selling price sat at over $891,000, including a June 2020 average price of almost $931,000.

“A gradually improving labour market and historically low mortgage rates are expected to support a recovery in home sales in the second half of 2020 along with sustained year-over-year price growth. Given that home sales result in substantial spin-off expenditure in the regional economy, the housing market will be an important driver of overall economic recovery this year and into 2021,” said Jason Mercer, TRREB’s Chief Market Analyst.

It is very important to note that the guidance provided above is predicated on the continued reopening of the economy, a gradually improving labour market situation in the GTA and sustained low borrowing costs. There remain substantial downside risks to the housing market, including:

- A resurgence in COVID-19 cases, which could prompt a pause or even dialing back of the reopening in the GTA, and the economic impacts; and

- A negative economic impact associated with the resurgence of COVID-19 cases in the United States, which could continue to impact trade, employment and overall household wealth via equity markets.

For additional information on TRREB’s guidance on economic recovery related to the real estate sector, click here.

Media Inquiries:

Mary Gallagher,

Senior Manager, Public Affairs maryg@trebnet.net 416-443-8158

The Toronto Regional Real Estate Board is Canada’s largest real estate board with more than 56,000 residential and commercial professionals connecting people, property and communities.