TORONTO, ONTARIO, May 5, 2020 – Toronto Regional Real Estate Board President Michael Collins released the following key housing market statistics for April 2020:

Home Sales and Listings

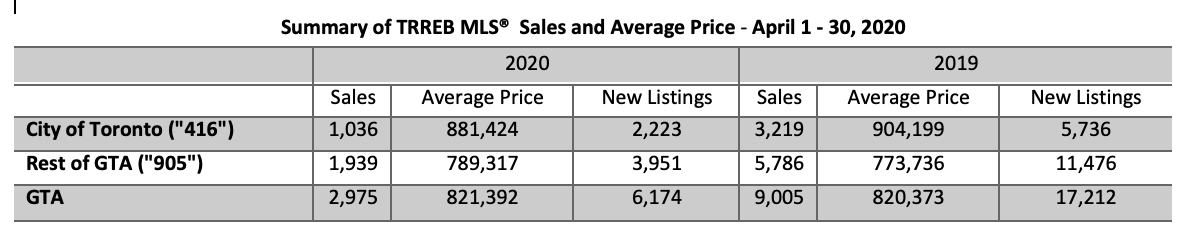

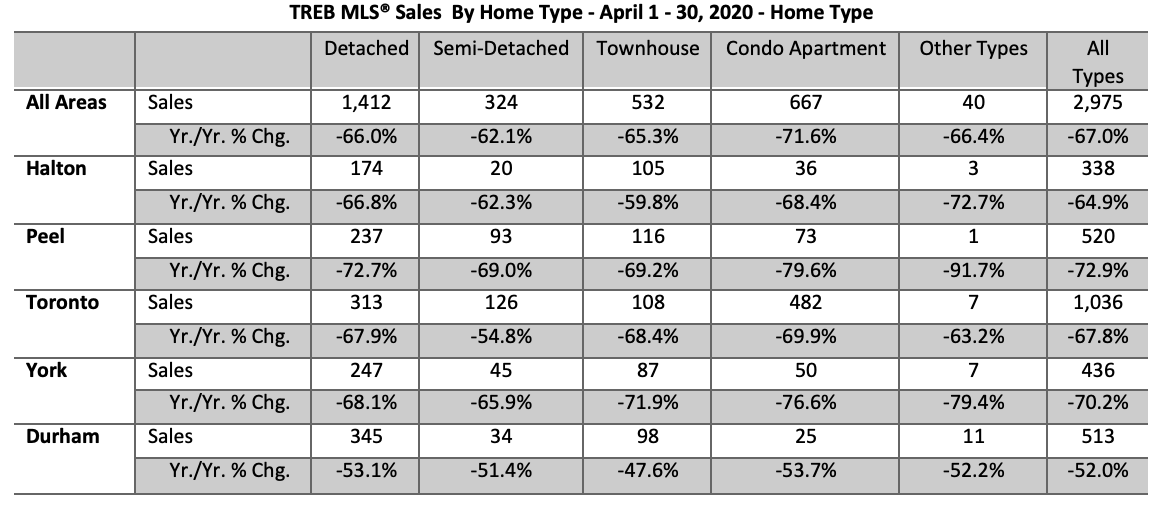

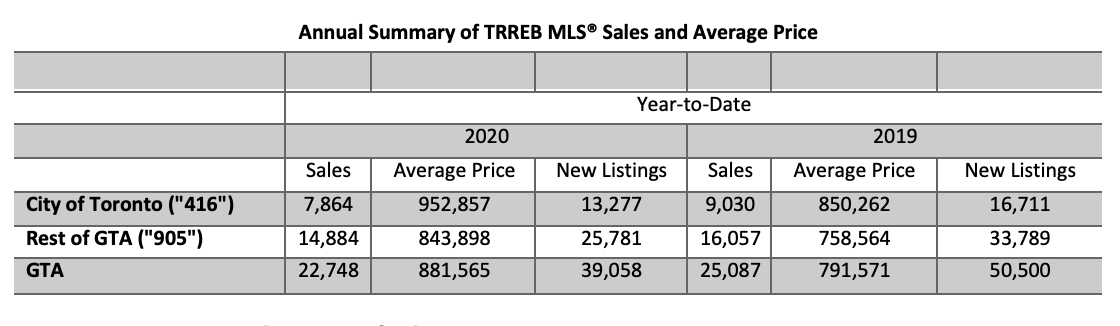

- Greater Toronto Area REALTORS® reported 2,975 residential transactions through TRREB’s MLS® System. This result was down by 67 per cent compared to April 2019. Weekday sales remained within a relatively steady range during the month, averaging 130 per day.

- New listings amounted to 6,174 in April 2020 – down on a year-over-year basis by a similar rate compared to sales (-64.1 per cent).

“The necessary social distancing and economic impacts associated with COVID-19 clearly impacted home sales and listings throughout April 2020. However, REALTORS® have been able to facilitate some transactions on behalf of buyers and sellers through the use of innovative techniques including virtual open houses. TRREB has also provided a live stream virtual open house option on Member listings featured on our public websites, and I would expect the use of these innovative techniques to increase as some level of social distancing remains in place for the foreseeable future,” said Mr. Collins.

“TRREB Members should continue to follow directives and guidance being given by the government and public health agencies. TRREB’s professional development staff are continuously working to educate our Members via virtual webinars on using technology in innovative ways to conduct business virtually, including video, virtual tours and the use of electronic forms wherever possible,” said TRREB CEO John DiMichele.

Home Prices

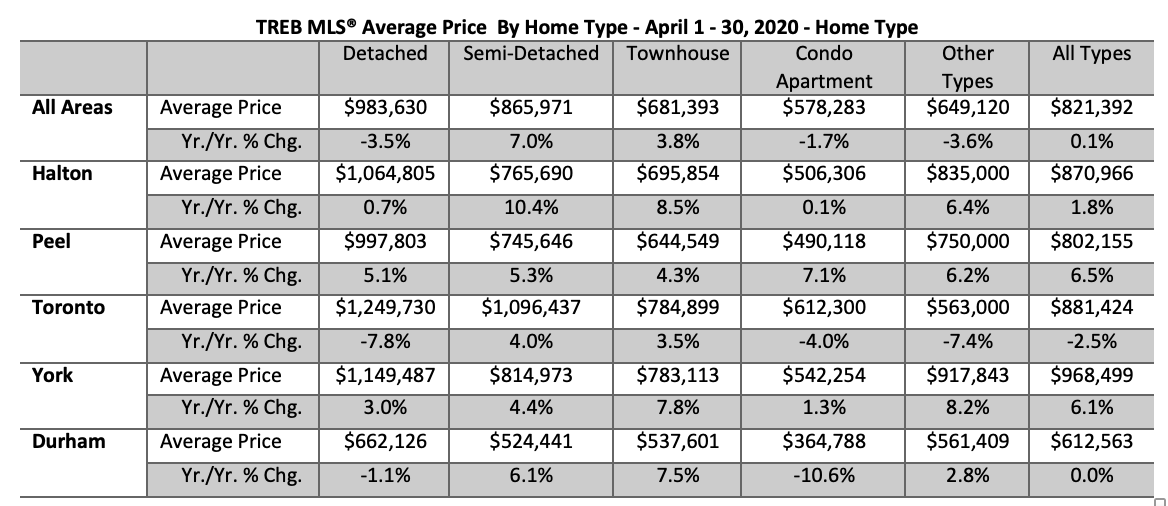

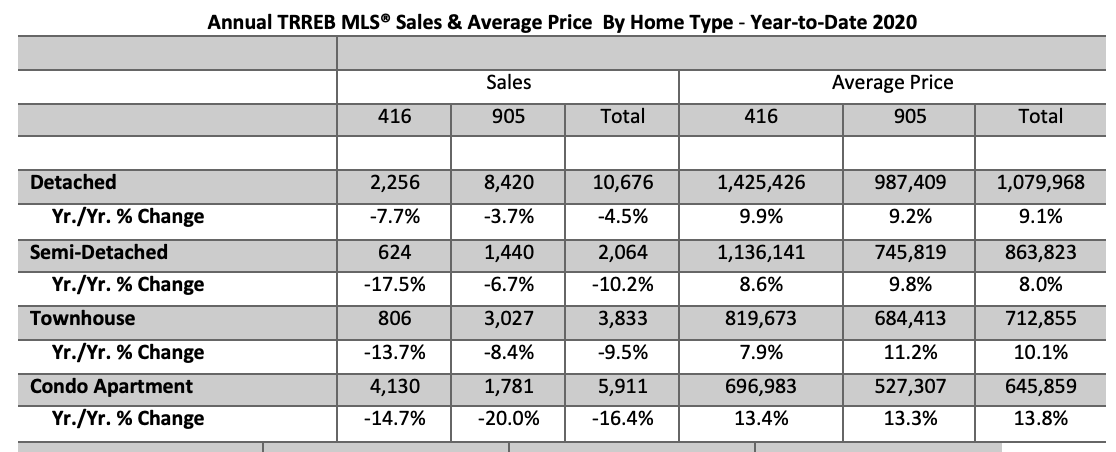

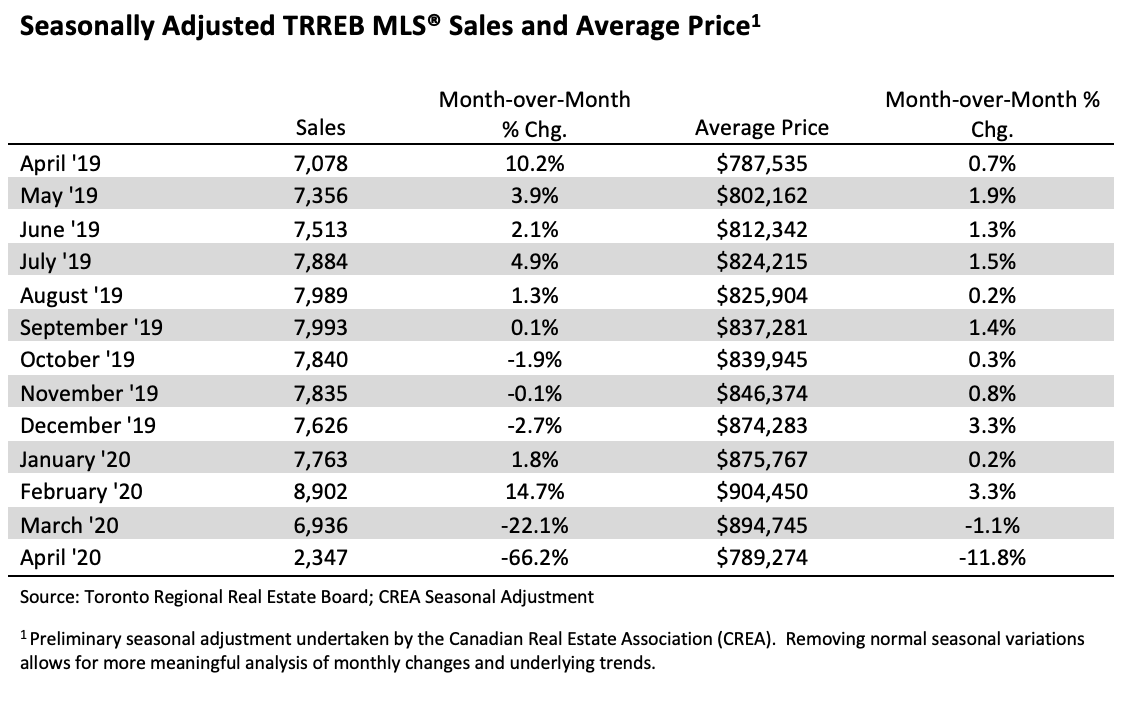

- The average selling price for April 2020 transactions was $821,392 – up by 0.1 per cent compared to the average price of $820,373 reported for April 2019. The semi-detached and townhouse market segments experienced annual average price growth above the rate of inflation. The condominium apartment and detached segments experienced year-over-year price declines on average.

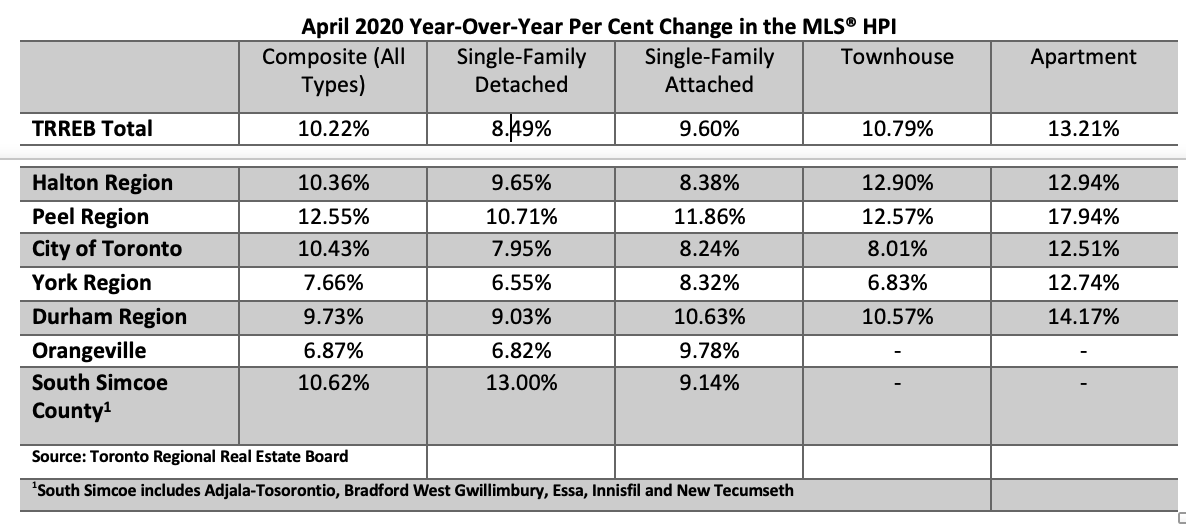

- The trend for the MLS® Home Price Index Composite Benchmark, which had been on an upward trajectory since the beginning of 2019 flattened in April. On a year-over-year basis, the Benchmark was up by 10 per cent.

- The MLS® HPI indices represent prices for typical homes with consistent attributes from one period to the next. The fact that the MLS® HPI was up year-over-year by a greater rate than the average selling price suggests that the share of higher-enddeals completed in April 2020 versus April 2019 was down.

“When thinking about home prices, it is important to remember that the pace of price growth is dictated by the relationship between sales and listings. So, while the onset of COVID-19 has understandably shifted market conditions and resulted in average selling prices coming off their March peak, there has continued to be enough active buyers relative to available listings to keep prices in line with last year’s levels,” said Jason Mercer, TRREB’s Chief Market Analyst.

Condominium Apartment Rental Market

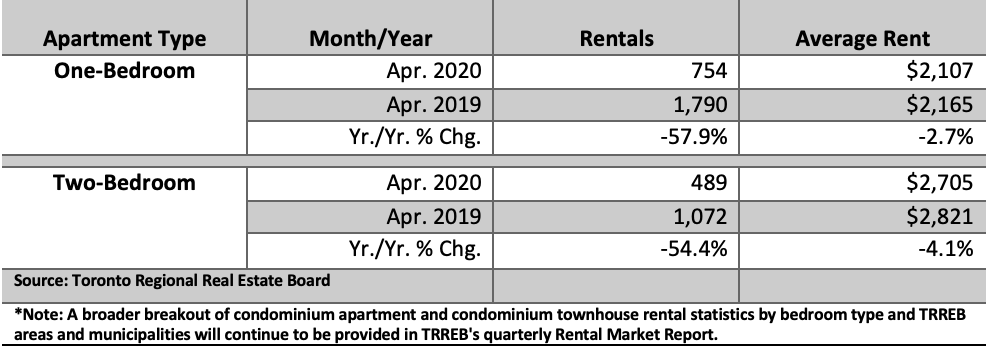

TRREB is also providing summary condominium apartment rental market statistics for April 2020. Conditions in the GTA rental market have also changed since the first quarter of 2020.

- Rental transactions reported through TRREB’s MLS® System were down on a year-over-year basis in April for both one-bedroom and two-bedroom condominium apartments.

- One-bedroom condominium apartment rental transactions were down by 57.9 per cent to 754; two-bedroom rental transactions were down by 54.4 per cent to 489.

- Average rents for one-bedroom and two-bedroom apartments were down on a year-over-year basis in April 2020 as well. The average one-bedroom rent was $2,107 – down 2.7 per cent compared to April 2019. The average two-bedroom rent was $2,705 – down 4.1 per cent compared to April 2019.

“These are unprecedented times. Past recessions and recoveries do not necessarily provide the best guide as to how the housing market will recover from the impact of the COVID-19 pandemic. A key factor for the housing market recovery will be a broader reopening of the economy, which will result in an improving employment picture and a resurgence in consumer confidence. To this end, it is reassuring that the province is taking measured and carefully monitored steps towards safely opening up some parts of the economy,” said Mr. DiMichele.